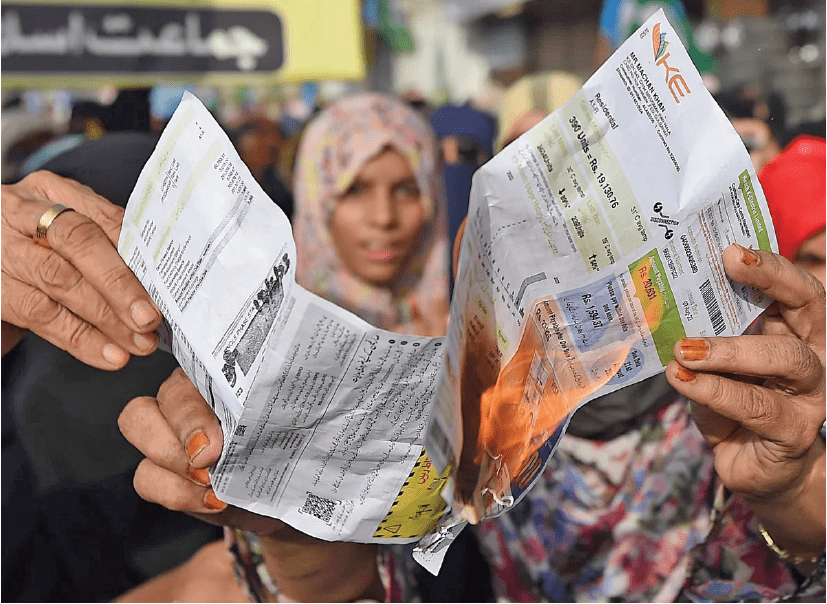

For the first time, access to basic amenities like electricity is no longer an issue that just confounds the working class. It seems the elite businessmen, the famed celebrity and the stable middle class have also fallen prey to the crisis of inexplicable overbilling. The costs no longer seem to match actual energy consumption by household. The shock is very much evident; for instance, a Lahore resident was forced to go to court against the Lahore Electric Supply Company (LESCO) regarding a bill payment of Rs.150,000 over a mere usage of 126 units.

The string of excuses ranging from lack of cooperation from power authorities, unreadable bills, hidden sub-charges to issues with meter readings have plagued residential and commercial electricity bills. This may not be a new issue. While the public has been agitating over this predicament for years, now even the business sector has finally unleash their wrath against Independent Power Producers (IPPS). While unreasonable power cuts and electricity tariff hikes do play a role, what is more crucial for the recent pain felt by the business community – particularly the textile lobby – has to do with the recent withdrawal of various concessions awarded at the IMF’s behest.

To make matters even worse, Former Interim Commerce Minister Dr. Gohar Ejaz blamed the unbearable capacity charges for power woes. In simple terms, capacity charges are the fees/rents that the government pays the IPPs to maintain electricity generation – regardless of level of actual consumption and production. Dr. Gohar, along with many experts, has highlighted the need for slashing taxes, reforming parliamentary legislation and ordering forensic audits of IPPs over allegations of corruption.

Even President Asif Zardari felt compelled enough to voice his opinion on the subject. In the wake of nationwide strikes particularly those led by JUIF and the commotion in business community who are now demanding accountability for the ongoing energy crisis, such massive power cuts and unfair energy costs are now too big to ignore.

This situation begs a fundamental question. What are the reasons that IPP capacity charges have become a pandora’s box for the Pakistani populous? IPPs are privately owned power plants that are only responsible for up to 15 percent of the nation’s capacity payments, yet they still get many perks within the power industry that unfortunately impact the masses negatively. In comparison, 45 percent of capacity payment goes to government-run power plants and 40 percent to plants operated under CPEC’s umbrella projects.

Currently, power rates have been hiked up to Rs. 70 per unit that includes additional capacity surcharge of Rs.24 that has led to mass discontent in the face of rapid inflation. Hence, to understand the masses frustration against unreasonable hikes in power billing, a snapshot of the role, origin and cons of IPPs is vital for our understanding.

IPPs were introduced as a break from Pakistan’s nationalization policy to originally make up for the losses in the power sector by attracting private investment in 1994. Ironically, privatization and liberation of the power sector only made it a wormhole of losses and rising electricity tariffs.

Firstly, the monopolization of the power industry by the top forty families was initially meant to offset the state load but like all dynastic tales, it instead served to attract consumer rage over issues of transparency, profiteering and accountability given that private stakeholders are the only party that benefited. Coupled with the profiteering of the forty-power plant, operational inefficiency of IPPs remains an enigma that contributes to energy losses.

An example of this is seen by how the total power production capacity of IPPs is 45,000 megawatt but it seems only 22,000 megawatts are being utilized so underproduction of electricity by the plants themselves in the face of surplus demand is an issue. In the face of such circumstances, the exorbitant capacity charges regardless of actual production and consumption is even more unfair and serves to unhinge the consumer who is forced to pay for a below par and unfulfilled basic demand. This is the predicament seen by the example of how 1.93 trillion capacity payments were made over the past two fiscal years but what is shocking is 46 billion rupees alone was paid 16to two power producers- namely Hubco and Kott Addu Power Company (KAPCO)- which ironically were responsible for generating not even one unit of electricity. Such a degree of “ghost power plants” are a perfect example of operational corruption by those who have monopolized the industry.

Besides monopolization, industrial profiteering and operational inefficiency, it is important to understand the advantages and perks historically enjoyed by IPPs since their founding. The costly nature of IPPs is not just due cost of electricity generation itself or even capacity payments but it also includes an array of other hidden elevated costs such as taxes liable to the government, fuel costs and guaranteed returns on investments

Particularly, to make things worse, the issue of exorbitant taxes has strangled the power industry. Rs. 25 tax on every unit of electricity consumption remains which just seems to serve the needs of both the private industry – who now have a reason to expand the scope of their payments- and ironically the main beneficiary which includes the government.

This state-industrial complex dates back to the unfair perks and sovereign guarantees given to IPPs as the government is liable for payments even if IPPs make delayed payments or face contractual losses. Ironically, this places more pressure on the government as it still needs its share of profit so it continues on the destructive path of supporting the loss-making industry that charges its consumers with exorbitant amounts despite IPPs being a liability.

In a way, the government benefits but also makes a loss. Given overbilling and capacity payments, not only is the consumer burdened by energy losses but so is the government as payment delays and financial inefficiencies often lead to an economic downturn. This is because the power sector is caught (literally) in the vicious circle of circular debt.

Unfortunately, the original loser still remains the consumer. As Korangi Association of Trade and Industry’s President said: “IPPs are still receiving more money than the nation’s defense budget.” He added that the time had come for the will of the “240 million people of Pakistan to take precedence over the interests of the 40 families running these IPPs.”

While the demands of trader associations to hold IPPs accountable is not unreasonable, the issue is that IPPs enjoy legal protection and sovereign guarantees from the government of Pakistan.

This is why Dr. Gohar Ejaz’s demand of a financial and operational audit of IPPs over issues of misgovernance and fuel procurements may be the only legitimate way to dig into the sector’s fault lines and if we wish to hold it accountable to some degree.

The question remains: what next? What are the practical ways forward of cleaning up the mess left behind by IPPs and how quickly can it be done? For this to be possible, the government must eventually abandon this liability and the perks awarded to the sector.

The writer is our Editorial Assistant and political economy, international relations analyst.